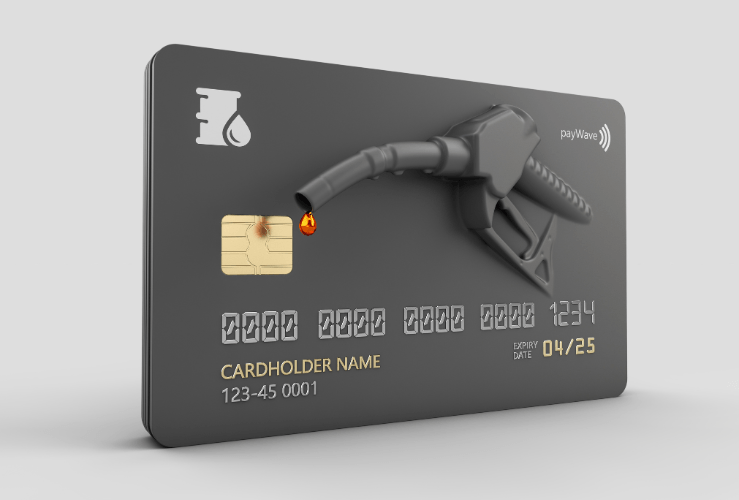

Fuel cards are promoted as a way to streamline the management of fuel purchases for large fleets and to save on fuel, with some offering discounts of several pence per litre.

While such savings may sound modest, when used across an entire fleet they could add up to significant cost savings each year.

However, it's important to choose a fuel card that meets the needs of your business, since each card has pros and cons for different customers.

How do you use a fuel card?

Fuel cards work like contactless credit cards - but are generally only used for paying for fuel. A driver fills up, then pays with their fuel card - either by swiping or entering a pin (like a regular credit/debit card).

Who are fuel cards for?

While most of us use our contactless bank cards to pay for fuel, fuel cards are provided by companies/organisations to employees who drive a lot as part of their work.

Emergency services, large building firms, and delivery companies all use fuel cards.

What are the advantages of fuel cards?

Aside from potential cost savings (see below), using a fuel card could help:

- Minimise fraud (it can be difficult to manage multiple credit cards issued to employees).

- Streamline accounting (see below).

- Result in less paperwork/hassle for drivers (no more 'pay and reclaim').

- Self-employed people, so long as they are VAT-registered.

What are the disadvantages of fuel cards?

- Some cards charge an annual fee of £10-20 per annum.

- A given card might not be usable at all fuel stations.

- The card could be used by someone else if mislaid or stolen (depending on security measures).

- Individuals cannot use them.

Fuel card advantages: in-depth

Fixed Weekly vs Pump Price

Pricing options include fixed weekly pricing, pump pricing and pay-as-you-go.

With weekly pricing, you know how much each litre will cost for the week.

With pump pricing, the business is open to fluctuations in the fuel price. The most attractive 'pump price' cards offer a per-litre discount across their network, or the ability to use lower-cost supermarket sites.

Pay-as-you-go allows users to pre-pay, thereby exerting more cash flow control.

Easy account management

Fuel cards usually come with integrated account management software, which allows the fleet manager to see how much has been spent, and whether or not drivers are filling up at cheaper sites (such as supermarkets). If they aren’t, managers can encourage drivers to use more affordable sites.

Of course, for some drivers, it may not be practical to seek out a cheaper supermarket site on their route, for example.

Simple cash flow management

With account management apps, a manager can track how much is being spent - and won’t get a sudden influx of 'pay and reclaim' invoices from their drivers at the end of the month. In this way, cash flow can be better managed - which can be critical for some firms.

Less time on administration

Fuel cards get rid of the old 'pay and reclaim' system, meaning you don’t have to deal with receipts. This streamlines the process of managing refuelling and associated costs, and means the driver doesn't have to worry about having sufficient funds to cover fuel costs.

Today's fuel card systems also produce single HMRC-compliant invoices, reducing time spent on paperwork.

Credit: William - stock.adobe.com

Can you get EV "fuel" cards?

Yes, there are a host of electric vehicle fuel cards on offer, some that also offer discounts on regular fuel (ideal if a fleet uses hybrid vehicles). These are normally called EV charge cards - see below for popular providers.

How does an EV charge card work?

An EV charge card works in a similar way to a regular fuel card. It uses the RFID (Radio Frequency IDentification) system which allows for contactless payments at designated charge points.

Each EV charge card will have access to a specific network or set of networks. For example, one may allow charging at both BP and Texaco sites, while other may allow charging across multiple networks.

Fuel cards: Top Providers

The fuel card industry is highly competitive, with many options. The available cards differ in terms of how they work, how they are priced, and which type of vehicle they are for (i.e. petrol, diesel, hybrid and/or EV). It's important to choose the best one for your business's needs.

Here are some of the most popular fuel cards and EV charge cards:

Allstar One

The Allstar One claims to have 90% UK network coverage (7700+ sites), and offers savings of up to 8p per litre. They are also HMRC-compliant, making invoicing quicker and easier.

The card also offers savings on diesel bought across 1,600 sites.

Network service fee of £3; 'Underused Account Fee' of £9.99 per month.

Allstar Supermarket

This card is geared towards supermarket sites, which are invariably cheaper than standard fuel sites, such as on motorways. 3000+ locations.

Network service fee of £3; 'Underused Account Fee' of £9.99 per month.

Credit: Menyhert - stock.adobe.com

The Right Fuel Card Company

This fuel card broker offers an impressive 11 cards. Their BP range includes:

- BP Bunker: for fleets with large diesel-engine vehicles. 1200 sites, including 600 bunker stations where fuel can be bought in bulk.

- BP List (weekly fuel rates) and BP Pump Price (pay the pump price): for fleets of vans and/or cars. 3400+ sites. Surcharges for using sites other than BP, Esso, Gulf and Texaco.

Card fees for the above 3: £1 per month.

- BP + Aral: This card covers 24,000 stations across 32 European countries. A good choice for those running international haulage firms. No sign-up fees. Fees reduce the larger your fleet is, so it benefits growing companies with 200+ vehicles.

NB: All BP cards require the driver to enter a pin, so you won’t be out of pocket if someone else tries to use it. They also have an alert feature that lets you know when a purchase has been made, or if fraudulent activity has been detected.

The Fuelstore

This provider offers cards with fixed weekly prices, helping manage your budget and cash flow. Alongside 24/7 transaction and fuel reporting, you'll get HMRC-compliant invoices and 14 days of free credit.

The main cards are The Fuel Store Card, The Esso Card™ National - and the Advantage Card, which works on a prepaid basis, enabling better cash flow management.

All three work with 3500+ sites and cost 15 GBP per year.

Keyfuels

Keyfuels offer two cards:

- Pay-As-You-Go: fixed weekly rate; fee included in fuel price; 3500 UK stations.

- Direct: Pay per litre based on fuel consumption; allows you to negotiate directly with fuel suppliers; 3500 UK stations.

EV charge cards: Top providers

Allstar One Electric card

As the name implies, this card is for EVs, with 10,300+ sites available for use.

Network service fee of £3; 'Underused Account Fee' of £9.99 per month.

BP Fuel & Charge

This card is for EVs and covers 8,750 charging points, with no sign-up fees. As the name suggests, it can also be used for buying fuel.

Looking for business breakdown cover?

At Start Rescue, we offer comprehensive business breakdown cover to keep your business vehicles on the road, whether you have a single van or a large commercial fleet. Enjoy reliable protection for cars, motorcycles, vans, and more, ensuring your business stays productive.